mashine-spb-exp.ru

Tools

Is Life Insurance A Good Idea

Life Insurance coverage is an important part of everyone's financial plan – but not everyone needs the same life insurance coverage. Whole life insurance is designed to last your entire life. It will never expire as long as you continue to pay premiums, which will never change. In addition to. Life insurance can be a valuable investment, as a policy can help financially support your loved ones after your death. It can also help cover large debts. Insurance is an important financial tool. It can help you live life with fewer worries knowing you'll receive financial assistance after a disaster or accident. Life insurance benefits can help replace your income if you pass away. This means your beneficiaries could use the money to help cover essential expenses, such. According to eFinancial, the cost of a year, $, term life insurance policy is typically between $21 and $29 per month for a healthy 20 to year-old. While many people feel life insurance is worth it, whether or not life insurance is a good investment for you depends on your unique personal finance situation. Life insurance benefits can help replace your income if you pass away. This means your beneficiaries could use the money to help cover essential expenses, such. Life insurance helps to financially protect your family when you pass, and it's a good idea for many people. But there are other ways to support your family. Life Insurance coverage is an important part of everyone's financial plan – but not everyone needs the same life insurance coverage. Whole life insurance is designed to last your entire life. It will never expire as long as you continue to pay premiums, which will never change. In addition to. Life insurance can be a valuable investment, as a policy can help financially support your loved ones after your death. It can also help cover large debts. Insurance is an important financial tool. It can help you live life with fewer worries knowing you'll receive financial assistance after a disaster or accident. Life insurance benefits can help replace your income if you pass away. This means your beneficiaries could use the money to help cover essential expenses, such. According to eFinancial, the cost of a year, $, term life insurance policy is typically between $21 and $29 per month for a healthy 20 to year-old. While many people feel life insurance is worth it, whether or not life insurance is a good investment for you depends on your unique personal finance situation. Life insurance benefits can help replace your income if you pass away. This means your beneficiaries could use the money to help cover essential expenses, such. Life insurance helps to financially protect your family when you pass, and it's a good idea for many people. But there are other ways to support your family.

A cash value life insurance policy may be worth considering if you want long-term coverage and the ability to access savings later in life. But if you don't. Term life insurance may not have a big monthly impact on your budget (which is a good thing) but it can have a big impact on feeling settled and confident that. The most common use of life insurance is to provide an immediate pool of assets that can replace the insured's income or savings potential to meet the needs of. It's meant to cover you for a short period of time, and for a specific purpose. What it's not meant to do is to replace your existing life insurance coverage or. It could be a good option for those who have reached the caps on their investment accounts, like (k)s, IRAs, and plans. Life insurance for young people is a particularly good idea if you have dependents who rely on your income, you have a lot of debt, or you want to lock in. That's why it may be a good idea to buy a life insurance policy when you're young and healthy. For example, a year-old man in excellent health can purchase a. Life insurance for young people is a particularly good idea if you have dependents who rely on your income, you have a lot of debt, or you want to lock in. The main benefit to level term life insurance is that it is very affordable, with low monthly premiums and the ability to cover you for the period of time most. Life insurance helps to financially protect your family when you pass, and it's a good idea for many people. But there are other ways to support your family. Not everyone needs life insurance. In general, life insurance is a good idea if you have family or others who rely on you financially. The right life insurance policy provides peace of mind if your family cannot replace your income, settle your estate, or pay for end-of-life expenses. Bear in. Life insurance for children offers lower premium rates, lifelong coverage, and the potential to secure additional coverage as they grow older. · It can provide. Life insurance is an important part of how you protect your family's finances if the unthinkable happens, but can be an overlooked option when enrolling for. When it comes to getting the most out of your life insurance policy, a life settlement is almost always a better choice than surrendering it or letting it lapse. It can be a cost-effective way to get a substantial payout, so it may be a good choice for people with young children who need a lot of coverage to replace. Whole life policies offer cash value, which the policyholder can access while they are alive. Buying Life Insurance at How Are Life Insurance Rates Set? The. That way, in the wake of a premature death, they are able to replace the lost income that they depend upon. But it also can be a good idea to insure a non-. Social security benefits, available cash and other sources of income and investments may not provide the standard of living you have in mind. Life insurance. When you buy health insurance, it's to help protect yourself from the financial risk of serious medical expenses. Similarly, when you buy life insurance, it's.

When Can I Buy Options On Robinhood

1 contract is always shares. That's how they're traded in the market, so no platform will allow you to buy an option of less than shares. E*TRADE does a good job of segmenting experiences according to investor type, making it a better option for more active traders and experienced investors. To get started trading options on Robinhood, you need to open and fund an account. You can download the app to your smartphone or access the sign-up page on a. Trading Vertical Option Spreads On Robinhood: Effectively trade option spreads for low risk, consistent profits - Kindle edition by Keen, Dan. If your option is in the money on the expiration date, the contract will automatically execute to either buy or sell the shares of the underlying stock. If the. Once you hit that button, you will be shown what's available for the option trade. · Put Options · As you can see, the features are nearly identical as it was for. Robinhood doesn't support options trading on stocks we don't have on the platform. For a guide to eligible stocks on our platform, check out Investments you can. Trade stocks, ETFs, and now options without worrying about pattern day trade restrictions. Options and cash accounts—together at last. No contract fees. No. Our Options Knowledge Center explains terminology, basic and advanced trading strategies, and how to place an options trade on Robinhood. 1 contract is always shares. That's how they're traded in the market, so no platform will allow you to buy an option of less than shares. E*TRADE does a good job of segmenting experiences according to investor type, making it a better option for more active traders and experienced investors. To get started trading options on Robinhood, you need to open and fund an account. You can download the app to your smartphone or access the sign-up page on a. Trading Vertical Option Spreads On Robinhood: Effectively trade option spreads for low risk, consistent profits - Kindle edition by Keen, Dan. If your option is in the money on the expiration date, the contract will automatically execute to either buy or sell the shares of the underlying stock. If the. Once you hit that button, you will be shown what's available for the option trade. · Put Options · As you can see, the features are nearly identical as it was for. Robinhood doesn't support options trading on stocks we don't have on the platform. For a guide to eligible stocks on our platform, check out Investments you can. Trade stocks, ETFs, and now options without worrying about pattern day trade restrictions. Options and cash accounts—together at last. No contract fees. No. Our Options Knowledge Center explains terminology, basic and advanced trading strategies, and how to place an options trade on Robinhood.

Step by Step: Trading Options on Robinhood · Understand the Basics. While options are traded like stocks, stocks and options are not interchangeable. · Recognize. How do I enable options in Robinhood Retirement? You'll be able to seamlessly switch between trading accounts. Before you place a trade, make sure you. The options trading product primarily targets the retail investors, who are fairly new to investing in the market. These newcomers to options. Start searching for the security (stock) that you would like to trade options for. To search, simply click on the magnifying glass icon on your home page. Market hours are AM–4 PM ET · Extended hours are 7– AM ET and 4–8 PM ET. When do equity and ETF options stop trading? Options on most underlyings cease trading when the market closes at pm Central Time (Chicago Time). However. A limit order will only be executed if options contracts are available at your specific limit price or better. There are additional, unique risks with trading outside of regular market hours you should be aware of before making an investment decision, including the risk. There's no commission fee to buy or sell options, nor is there a monthly fee. A driving commitment to offer you the best experience at low cost. With extended-hours trading and the Robinhood 24 Hour Market, you can execute trades from 8 PM ET Sunday until 8 PM ET Friday, with some restrictions. At Robinhood, you must already own shares of the underlying stock or ETF to sell a call. In options trading, short describes selling to open, or writing an. Approval on Robinhood takes around 24 hours, with the app verifying users via email within one trading day. The verified user will need to link. When you make a trade during overnight hours (between 8 PM AM ET), the trade date will actually be the next trading day. For example, if you buy 2 shares of. If the early exercise occurs after 4 PM ET, it'll be queued for the next trading day, and the associated shares will remain pending until the exercise has. You can trade/sell options that you bought without risking any more than what you paid for the option. If you bought the option, you did not. Yes, it is possible to make money trading options on Robinhood or other stock brokers. Options trading involves buying and selling financial contracts. Robinhood is commission free and without per-contract fees, a rare advantage in the options investing arena. To help retail investors understand what they're. Why can't I trade options with Instant Deposits? Why can't I trade options with Instant Deposits? When can I trade options? When can I trade options? Was. Future trading is not available, not are mutual funds or bonds. They make their money on selling your order flow – but they got dinged by FINRA in December

Worth It To Refinance Mortgage

Because it could end up costing them more money or be more work than it's worth. If you're considering getting a new loan, weigh these pros and cons to decide. Refinancing can potentially lower your monthly mortgage payment, pay off your mortgage faster or get cash out for that project you've been planning. Even if you keep the same rate and a "no closing cost" refinance, you monthly payments will drop because you're extending the length of the loan. 1. Get a lower interest rate and monthly payment. As a borrower, you could potentially save thousands of dollars over the term of your loan when you lock in a. It depends on the lender and closing costs to refinance. Rates for shorter term mortgage loans are typically less than longer term mortgages. If. Refinancing your mortgage can offer several financial benefits, including a lower interest rate, shorter loan term, and access to your home's equity. Lower your. Refinancing can save you money if you get a lower interest rate, but you could also end up paying more if you refinance simply to extend the loan term. If refinancing will lower the amount of interest you'll pay on your mortgage, then you may find this to be an option worth exploring. Not sure refinancing your. Award Winning Calculator determines if Refinancing makes sense using live mortgages and real data. Find out now exactly how much you can save or cash out. Because it could end up costing them more money or be more work than it's worth. If you're considering getting a new loan, weigh these pros and cons to decide. Refinancing can potentially lower your monthly mortgage payment, pay off your mortgage faster or get cash out for that project you've been planning. Even if you keep the same rate and a "no closing cost" refinance, you monthly payments will drop because you're extending the length of the loan. 1. Get a lower interest rate and monthly payment. As a borrower, you could potentially save thousands of dollars over the term of your loan when you lock in a. It depends on the lender and closing costs to refinance. Rates for shorter term mortgage loans are typically less than longer term mortgages. If. Refinancing your mortgage can offer several financial benefits, including a lower interest rate, shorter loan term, and access to your home's equity. Lower your. Refinancing can save you money if you get a lower interest rate, but you could also end up paying more if you refinance simply to extend the loan term. If refinancing will lower the amount of interest you'll pay on your mortgage, then you may find this to be an option worth exploring. Not sure refinancing your. Award Winning Calculator determines if Refinancing makes sense using live mortgages and real data. Find out now exactly how much you can save or cash out.

A general guideline for determining whether you should refinance your mortgage is that you should do it only if you can lower your interest rate by at least 2%. Pro: You could lower your monthly payment. Once of the obvious benefits of refinancing your mortgage is that you could secure a lower interest rate that would. The accepted rule of thumb has always been that it was only worth refinancing if you could reduce your interest rate by at least 2%. Today, though, even a 1%. One of the main advantages of refinancing regardless of equity is reducing an interest rate. Often, as people work through their careers and continue to make. One of the primary benefits of refinancing is the ability to reduce your interest rate. A lower interest rate may mean lower mortgage payments each month. Plus. Learn about the benefits of refinancing your mortgage, including lowering your interest rate or paying off your mortgage faster. Homeowners typically think about refinancing when current interest rates are lower than the rate on their mortgages. A lower interest rate might help them. The benefits of refinancing your mortgage which may include: · Reduce monthly mortgage payments · Get a lower interest rate · Convert your home equity into cash. Refinancing your mortgage can offer several financial benefits, including a lower interest rate, shorter loan term, and access to your home's equity. Lower your. Refinancing will reduce your monthly mortgage payment by $ By refinancing, you'll pay $47, more in the first 5 years. Whether you're looking to shorten your term, lower your monthly payment, consolidate debt or cash-out equity, choose Solarity Credit Union. We make refinancing. Refinancing a mortgage is generally considered a good idea if you can lower your rate by at least %. It can also be worth the effort if the amount you save. While a mortgage refinance is worth considering when you see this 1%+ reduction, there are other factors that need to be considered as well. When refinancing. You've probably asked yourself, “Is refinancing worth it?” In short, the answer is maybe—it depends on your circumstances. Refinancing from a year to a year mortgage could help you lock in a lower rate and save on interest costs, as long as you can afford a much higher monthly. In this way, refinancing your mortgage may help you save money by adjusting the interest rates or monthly loan payments attached to your current loan. However. 2. You can secure a lower interest rate. A lower interest rate is one of the best reasons to refinance your mortgage. This is because it means potentially. If the market value of your home is lower now than when you took your original mortgage, it may be harder to find a refinancing loan that is more favorable than. 75% may make it well worth your while to refinance. You can expect to pay You deserve to work with a firm and a Mortgage Loan Originator you can trust.

Calculating Interest Payments

Annual interest rate for this loan. Interest is calculated monthly on the current outstanding balance of your loan at 1/12 of the annual rate. Information and. Enter a loan amount, an annual percentage rate, and a term in years or months to view your estimated monthly payment, number of installments and total interest. To calculate simple interest, multiply the principal by the interest rate and then multiply by the loan term. · Divide the principal by the months in the loan. Our unsurpassed flexibility in payment plans, interest rate types, interest payments and maturity dates allow us to tailor each loan to fit your individual. = P × R × T,. Where,. P = Principal, it is the amount that initially borrowed from the bank or invested. R = Rate of Interest, it is at which. The online monthly interest calculator ensures quick computation on how to calculate interest and EMIs from the comfort of your home. Credit card APR is the interest rate you're charged each month on any unpaid card balance. Learn how to calculate your daily and monthly APR. Once you provide the loan amount, interest rate and term, the loan calculator will estimate your monthly payment and total interest. It also will show you a. How do you calculate interest on a credit card? · Divide your APR by (the number of days in a year) to get your daily periodic rate. · Multiply that number by. Annual interest rate for this loan. Interest is calculated monthly on the current outstanding balance of your loan at 1/12 of the annual rate. Information and. Enter a loan amount, an annual percentage rate, and a term in years or months to view your estimated monthly payment, number of installments and total interest. To calculate simple interest, multiply the principal by the interest rate and then multiply by the loan term. · Divide the principal by the months in the loan. Our unsurpassed flexibility in payment plans, interest rate types, interest payments and maturity dates allow us to tailor each loan to fit your individual. = P × R × T,. Where,. P = Principal, it is the amount that initially borrowed from the bank or invested. R = Rate of Interest, it is at which. The online monthly interest calculator ensures quick computation on how to calculate interest and EMIs from the comfort of your home. Credit card APR is the interest rate you're charged each month on any unpaid card balance. Learn how to calculate your daily and monthly APR. Once you provide the loan amount, interest rate and term, the loan calculator will estimate your monthly payment and total interest. It also will show you a. How do you calculate interest on a credit card? · Divide your APR by (the number of days in a year) to get your daily periodic rate. · Multiply that number by.

To find the interest due, multiply your daily periodic rate by the number of days in your billing cycle; therefore, 30 days x $ = $ in interest. Keep. We've put together a simple loan interest calculator to help you find out exactly how much interest you will pay. Credit Card Interest Calculator · Enter your current credit card balance · Enter your credit card's interest rate · Enter your average monthly payment, in. See how accrued interest could affect your loan balance. Even if you're not currently making loan payments, interest continues to accrue (grow). Microsoft Excel can help you manage your finances. Use Excel formulas to calculate interest on loans, savings plans, down payments, and more. Use our interest rate calculator to work out the interest rate you're receiving on credit cards, loans, mortgages or savings. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is. How much you'll pay in interest depends on a number of factors, including your credit history and credit scores, the type of loan, your loan term, loan amount. Multiply your principal balance by your interest rate. Divide your answer by days ( days in a leap year) to find your daily interest accrual or your per. You can calculate the monthly interest payment by dividing the annual interest rate by the loan term in months. Then, multiply that number by the loan balance. For example, if you currently owe $ on your credit card throughout the month and your current APR is %, you can calculate your monthly interest rate by. (The loan calculator can be used to calculate student loan payments, auto loans or to calculate your mortgage payments.) Want to find your interest rate? A savings interest rate calculator helps you determine the interest earned on your savings over time. Here's how you can use it. How to Calculate Payments · PMT = total payment each period · PV = present value of loan (loan amount) · i = period interest rate expressed as a decimal · n. This includes your payments to interest which add up to $3, over the life of the loan. This calculator uses monthly compounding and monthly payment. Calculate the credit card interest you'll owe for a given balance and interest rate. Choose your monthly payment and learn the payoff time. Mortgage Calculator ; Home Value: $ ; Down payment: $ % ; Loan Amount: $ ; Interest Rate: % ; Loan Term: years. Interest is calculated monthly at 1/th of the annual rate times the number of days in the month on the current outstanding balance of your loan. This loan calculator allows you to easily see your monthly payments and total interest on a loan. Just put in the loan amount, loan term, and interest rate. Divide your interest rate by the number of payments in a year (12) to get your monthly interest rate: ÷ 12 = · Then, multiply this monthly.

Buy Kilt

We carry a broad assortment of kilt pins, from traditional clan crest designs to exclusive designs crafted just for us. Each one is a wearable piece of art. Traditional Hand Stitched Kilts. We make kilts ourselves so can help you through the process of buying a kilt. View Kilts Made. Our Store. Tartan Shop @. Damn Near Kilt Em is an e-commerce seller of utility kilts, fashion kilts and premium kilt accessories. We offer only the best looking, best quality kilts. where I can buy some good quality kilts online Inexpensive and quality traditional, I reccomend stillwater kilts. I've got a few, with no. I'm interested on kilts from mashine-spb-exp.ru and mashine-spb-exp.ru The thing is that I'm not sure how trustworthy this pages are. You'll see the Original Sport Kilt, Works Kilt, and Ultimate kilt models SHOP. Mens Kilts + · Womens Kilts + · Kids Kilts + · Apparel +. HELP. My Account +. Our Kilts: Traditional Quality, Made in the USA, by American Kilt Makers. If you want your kilt made by an experienced American Kilt Maker, you've come to. Specialists in made-to-order handmade kilts, kilt jackets, sporrans & also Scottish, Irish / American Tartan Hybrids. Don't settle for cheap alternatives – Buy. Welcome to Stillwater Kilts online store, Bloomington MN. Affordable tartan kilts, sporrans and other kilt accessories. Secure online ordering. We carry a broad assortment of kilt pins, from traditional clan crest designs to exclusive designs crafted just for us. Each one is a wearable piece of art. Traditional Hand Stitched Kilts. We make kilts ourselves so can help you through the process of buying a kilt. View Kilts Made. Our Store. Tartan Shop @. Damn Near Kilt Em is an e-commerce seller of utility kilts, fashion kilts and premium kilt accessories. We offer only the best looking, best quality kilts. where I can buy some good quality kilts online Inexpensive and quality traditional, I reccomend stillwater kilts. I've got a few, with no. I'm interested on kilts from mashine-spb-exp.ru and mashine-spb-exp.ru The thing is that I'm not sure how trustworthy this pages are. You'll see the Original Sport Kilt, Works Kilt, and Ultimate kilt models SHOP. Mens Kilts + · Womens Kilts + · Kids Kilts + · Apparel +. HELP. My Account +. Our Kilts: Traditional Quality, Made in the USA, by American Kilt Makers. If you want your kilt made by an experienced American Kilt Maker, you've come to. Specialists in made-to-order handmade kilts, kilt jackets, sporrans & also Scottish, Irish / American Tartan Hybrids. Don't settle for cheap alternatives – Buy. Welcome to Stillwater Kilts online store, Bloomington MN. Affordable tartan kilts, sporrans and other kilt accessories. Secure online ordering.

Kilt sales and kilts for hire in Glasgow, Edinburgh, Prestwick, New York, Toronto, London & Manchester. Full selection of Scottish & Irish Tartans. Kilt Box Shop offers a wide range of authentic Scottish and Irish kilts, traditional tartans and accessories for a complete genuine look. Combining a heritage fabric and a modern cut, this on-trend, knee-length Skirt is a great work-to-weekend style. Shop the Celt Kilt. Modern utility kilts & cargo kilt collection for sale from UT Kilts, with SHOP. UTK Exclusives · Utility Kilts · Traditional Kilts · Accessories · Home and. Fashion Kilt™, USA - shop modern collection of mens kilts. We provide custom made kilts in authentic clan tartans including scottish, irish & welsh kilts. Our hassle-free return and exchange policy ensures that you are completely satisfied with your purchase. At Liberty Kilts, we are committed to providing a. Elevate your style with our range of formal and casual kilt wear at Atlanta Kilts. Find the perfect attire for any occasion. Shop now! The Kilt Company, Hire or Buy from our large range of Highland Outfits and Kilts. We have stores in Dunfermline, Dundee, East Kilbride, kinross and Perth. Buy Tartan Kilt - Traditional Kilt Tartan kilt is the symbol of Scottish culture. Our high-quality kilts are made for you to be in your rich. From the finest hand stitched kilts, made to measure jackets, Scottish made sporrans, Sgian-dubhs and belt buckles, we stock a huge selection of kilts. Looking to buy a kilt? Claymore Imports has authentic custom-made Scottish kilts for sale. Imported, great selection, and flat rate shipping. All our kilts are made-to-measure in Scotland by professionally trained and experienced kiltmakers. Kilt Rentals are a major part of our business. Experts in Kilts and Highland Dress since Kinloch Anderson supply the finest Kilts, Kilt Accessories, Scottish Tartans and luxury clothing and gifts. Accessories, sporrans, kilts, jackets and more | Find your highlandwear today from a traditional Scottish Kiltmakers. Scotland Kilt is online custom kilt sellers. We offer a wide range of custom-made Scottish clothing, including Scottish, Irish, Modern kilts, Sporran. Create your unique Scottish Mens Kilt Outfit with our Clan Tartans. Shop Kilts for Men, Wool Plaid, and Scottish Clothing, all tailored to perfection. Tartanista Value Kilt is a light weight 5 yard kilt with deep pleats and 3 buckles. perfect for everyday and sports events. All payments are Secured and Trusted. Outstanding customer service. Fast Response Time. Money Back Guarantee. Buy With Confidence. KILT SHOP · Sporrans · Kilt Pins · Belts & Buckles · Cufflinks · Sgian Dubh · Hose & Flashes · Ghillie Brogues · Mens Kilts.

Fidelity Commission

$ commission on all online U.S. equity purchases1; Among the most competitive margin rates in the industry; No annual fees. With a Fidelity® Cash. It comes with zero account fees, zero commissions* for online trading, and teens aren't tied to any minimum investment requirements. Users will also get access. $ commission applies to online US equity trades, exchange-traded funds (ETFs), and options (+ $ per contract fee) in a Fidelity retail account. Commission's Enforcement Committee, consisting of three Commission members appointed by the Commission chair. fidelity to such principal. A license. Fidelity brokerage fees. Transaction fee (TF) funds: A transaction fee is similar to a brokerage fee or commission which you pay when you buy or sell a stock. Follow-Up Implementation and Fidelity Evaluation of the Mental Health Commission of Canada's At Home/Chez Soi Project: Cross-site Report fidelity reports for. They offer $0 commissions to incentivize you to use their platform, so you're more likely to buy into their index funds or use their advisor services later on. Reasons to consider The Fidelity Account. Wide range of investment choices. $0 commission for online US stock, ETF. This page contains a list of all U.S.-listed ETFs and ETNs that are available for commission free trading within Fidelity trading accounts. $ commission on all online U.S. equity purchases1; Among the most competitive margin rates in the industry; No annual fees. With a Fidelity® Cash. It comes with zero account fees, zero commissions* for online trading, and teens aren't tied to any minimum investment requirements. Users will also get access. $ commission applies to online US equity trades, exchange-traded funds (ETFs), and options (+ $ per contract fee) in a Fidelity retail account. Commission's Enforcement Committee, consisting of three Commission members appointed by the Commission chair. fidelity to such principal. A license. Fidelity brokerage fees. Transaction fee (TF) funds: A transaction fee is similar to a brokerage fee or commission which you pay when you buy or sell a stock. Follow-Up Implementation and Fidelity Evaluation of the Mental Health Commission of Canada's At Home/Chez Soi Project: Cross-site Report fidelity reports for. They offer $0 commissions to incentivize you to use their platform, so you're more likely to buy into their index funds or use their advisor services later on. Reasons to consider The Fidelity Account. Wide range of investment choices. $0 commission for online US stock, ETF. This page contains a list of all U.S.-listed ETFs and ETNs that are available for commission free trading within Fidelity trading accounts.

See mashine-spb-exp.ru for further details. $ commission applies to online U.S. equity trades, exchange-traded funds (ETFs), and options (+ $ per. commission. The commission shall purchase for each of its members a fidelity bond executed by a surety company authorized to do business in the state, in. The Securities and Exchange Commission (SEC) oversees securities exchanges, securities brokers and dealers, investment advisors, and mutual funds in an. See the fact sheet and commission schedule for applicable fees and risks. The UC Savings Fund is not a mutual fund and is managed by the UC Office of the Chief. $0 commissions1 for online US stock, ETF, and option trades. Get margin rates as low as % Broad choice of investments. Access a range of investments. A consent order settled charges that Fidelity's acquisition of Chicago Title Corporation would reduce competition for title information services in San Luis. Current U.S. Securities and Exchange Commission (SEC) rules require us to Read our letter to the House Financial Services Committee on the Improving. Commission Letter Approving Amended Application Filed by Fidelity National Financial, Inc. For Approval of Divestiture of the Five Title Plant Assets To. Before placing a trade, consider Fidelity's most recent Brokerage Commission and Fee Schedule, available at mashine-spb-exp.ru or through a Fidelity representative. Before placing a trade, consider Fidelity's most recent Brokerage. Commission and Fee Schedule available at mashine-spb-exp.ru or through a Fidelity representative. Before placing a trade, consider Fidelity's most recent Brokerage Commission and Fee Schedule, available at mashine-spb-exp.ru or through a Fidelity representative. Learn about the commissions charged by Fidelity. Plus find out the non-trading fees of Fidelity, including the inactivity fee and the withdrawal fee. Looking to trade stocks online? Fidelity offers unlimited trades and low commissions with its stock trading account. Learn more here. Michigan Employment Relations Commission · Black Leadership Advisory Council · Commission on Middle Eastern American Affairs · Hispanic/Latino Commission of. This page contains a list of all US-listed ETFs and ETNs that are available for commission free trading within Fidelity trading accounts. Register of Charities - The Charity Commission THE FIDELITY UK FOUNDATION. Charity number: Charity reporting is up to date (on time). Skip to Content. Commission Documents. FIDELITY TELEVISION, INC. Full Title: FIDELITY TELEVISION, INC. Document Type: Memorandum Opinion and Order. Bureau(s): Mass Media. $0 commissions. Buy and sell US stocks and ETFs online commission-free Trade any amount. Buy. Fidelity Clearing Canada ULC. Collection. Orders and Exemptions. Date. Manitoba Securities Commission. Subjects. Local Acts, Rules and Policies. Law.

Planned Unit Development In Real Estate

Planned Unit Development (PUD) refers to a zoning designation that allows for the development of a mixed-use community or neighborhood. 1. The Planning Board reviews an application for a Planned Unit Development, which includes the submittal of a Preliminary Development Plan; the Planning Board. Planned unit developments are housing developments that are not subject to the standard zoning requirements, but instead work with the local government to. PUDs · Ownership of % of the unit, inside and outside, plus the lot underneath. · Maintenance of shared property (for example, landscaping outside of. A Planned Unit Development (PUD) is a community of homes that could look like single family residences, townhomes or condos, and can include both residential. The owner of property in a planned unit development plan or the owner of Real Estate Rental and Tenant Services. (34). Specialty Food Market (Bakery. Unattainable with traditional municipal zoning techniques, planned unit development provides flexibility in the regulation of land use development in order to . A planned unit development or PUD is a community of different types of homes that may include condominiums, commercial property, and single-family homes. A planned unit development (PUD) is a type of housing development that combines residential and commercial spaces with shared amenities and open areas. Planned Unit Development (PUD) refers to a zoning designation that allows for the development of a mixed-use community or neighborhood. 1. The Planning Board reviews an application for a Planned Unit Development, which includes the submittal of a Preliminary Development Plan; the Planning Board. Planned unit developments are housing developments that are not subject to the standard zoning requirements, but instead work with the local government to. PUDs · Ownership of % of the unit, inside and outside, plus the lot underneath. · Maintenance of shared property (for example, landscaping outside of. A Planned Unit Development (PUD) is a community of homes that could look like single family residences, townhomes or condos, and can include both residential. The owner of property in a planned unit development plan or the owner of Real Estate Rental and Tenant Services. (34). Specialty Food Market (Bakery. Unattainable with traditional municipal zoning techniques, planned unit development provides flexibility in the regulation of land use development in order to . A planned unit development or PUD is a community of different types of homes that may include condominiums, commercial property, and single-family homes. A planned unit development (PUD) is a type of housing development that combines residential and commercial spaces with shared amenities and open areas.

A PUD is made up of several one family homes, they can also be condominiums or townhouses, both residential and commercial. The surrounding property is. A planned unit development (PUD) is a cohesively designed community that real estate agents (“Better Real Estate Partner Agents”). Equal Housing. A Planned Unit Development (PUD) is intended to be a flexible zoning concept that encourages open space and preservation of natural features. A planned unit development (PUD) is a community of single-family homes or condos with shared amenities that don't adhere to standard zoning laws. A planned unit development (PUD) is a type of flexible, non-Euclidean zoning device that redefines the land uses allowed within a stated land area. A planned unit development (PUD) includes residential and commercial lots within one subdivision. Within a typical PUD are housing, residential recreation. What is a PUD? · A variety of housing options for residents; · A mixture of uses; · Increased open space; · Preservation of natural areas; · Landscape screening;. Everything You NEED To Know About Planned Unit Developments. PUDs, (planned unit development) are a unique feature in real estate. With PUDs you own your own. The planned-unit development shall further the purpose of promoting the general public welfare, encouraging the efficient use of land and resources, promoting. The tract or tracts of land included in a proposed planned unit development The holder of a valid written real estate option contract shall be deemed. In a PUD, there are often commercial properties that will serve the needs of their residents including stores and restaurants. In PUDs, there also can be. Planned unit developments (PUDs) are site-specific zoning designations that provide for a coordinated mix of uses and housing types. There are many PUD. Unlike the condominium project, which is essentially a creature of statutory origin, the planned development uses traditional real property concepts. In a. Planned Unit Developments for Commercial and Residential Real Estate While any type of development can be complicated, the planned unit development (PUD). PUD, short for Planned Unit Development, is a type of neighborhood where houses, parks, and other facilities are designed together in one big plan. Think of it. Planned Unit Development (PUD) Housing is a housing development that doesn't follow the zoning requirements in the area that are standard for housing. The project's owner is the Minoa Housing Co. I, LP, which consists of the Southern Hills Preservation Corp. and David Bacon as the general partners. Photo. A planned unit development may be defined in a local ordinance as an area of land in which a variety of residential, commercial, industrial, and other land. Planned Unit Development (PUD) is a housing development with a homeowners association that administers common property and facilities owned by all persons. Approval of a Concept Plan by the City Council pursuant to the PUD regulations shall confer upon the property owner or owners the right to submit a PUD Detail.

Highest Two Year Cd Rates

Summary of best CD rates. Here are the highest CD rates at top online banks and credit unions for term lengths from nine to 13 months: LendingClub: % APY. Or, invest $, or more and take advantage of higher rates paid on our Jumbo Certificates. CD - 2 Year. - Open An Account. CD - 2 Year. Minimum deposit. 2 Year CD Rates ; Purdue Federal Credit Union. 24 Month Savers' CD. ; Elements Financial. 24 Month Flex CD Special. ; MidCountry Bank. 24 Month Variable. CD Rates · 1 Year, $, %, %. Regular, IRA, SEP & Coverdell Month, $, %, %. Regular, IRA, SEP & Coverdell · 2 Year, $, %, %. Today's Rates for Bank5 Connect CDs ; 6 Month CD, %, %, $ ; 12 Month CD, %, %, $ After that the CD rates declined steadily. In late , just before the economy spiraled downward, they were at around 4%. In comparison, the average one-year. 1 year, years, 2 years, 3 years, 4 years, 5 years. Max. term length. Select 1 month, 6 months, 1 year, years, 2 years, 3 years, 4 years, 5 years, 5+. Best CD Rates & Savings Rates ; Merchants Bank of Indiana, Savings, % ↑ (up from %) ; Ameriprise Bank, 2 Year CD, % ↑ (up from %). Highest 2-Year CD Rates The highest 2-year CD rates are currently around % to %, which is much more than the average account earns. According to the. Summary of best CD rates. Here are the highest CD rates at top online banks and credit unions for term lengths from nine to 13 months: LendingClub: % APY. Or, invest $, or more and take advantage of higher rates paid on our Jumbo Certificates. CD - 2 Year. - Open An Account. CD - 2 Year. Minimum deposit. 2 Year CD Rates ; Purdue Federal Credit Union. 24 Month Savers' CD. ; Elements Financial. 24 Month Flex CD Special. ; MidCountry Bank. 24 Month Variable. CD Rates · 1 Year, $, %, %. Regular, IRA, SEP & Coverdell Month, $, %, %. Regular, IRA, SEP & Coverdell · 2 Year, $, %, %. Today's Rates for Bank5 Connect CDs ; 6 Month CD, %, %, $ ; 12 Month CD, %, %, $ After that the CD rates declined steadily. In late , just before the economy spiraled downward, they were at around 4%. In comparison, the average one-year. 1 year, years, 2 years, 3 years, 4 years, 5 years. Max. term length. Select 1 month, 6 months, 1 year, years, 2 years, 3 years, 4 years, 5 years, 5+. Best CD Rates & Savings Rates ; Merchants Bank of Indiana, Savings, % ↑ (up from %) ; Ameriprise Bank, 2 Year CD, % ↑ (up from %). Highest 2-Year CD Rates The highest 2-year CD rates are currently around % to %, which is much more than the average account earns. According to the.

rates have gone up, which is currently generating about $k/year in interest. Part of my plan for the next two years is to generate. CD Renewal Rates ; Renewed 1-year CD, %, % ; Renewed 2-year CD, %, % ; Renewed 3-year CD, %, %. Annual percentage yield (APY)2: %; Available with a Citizens Quest® or high yields or to roll over an existing Citizens CD. * Wireless carrier. Who has the highest month CD rate? Navy Federal Credit Union offers % APY for 12 months. What is the highest-paying CD rate right now? The best rate on a 2-year CD available nationwide is % APY available at USALLIANCE Federal Credit Union. How to Find the Best Jumbo CD Rates · Lennox Employees Credit Union. APY: %. Term: 18 months · One American Bank. APY: %. Term: 5 and 11 months · KS State. Supercharge your savings in just 1 year. Lock in a sky-high % APY* before rates drop. First Internet Bank's two-year CD couples a high % APY on its two-year CD with a low minimum deposit requirement, which is ideal for new savers. None of its. The ones that are call protected are to %. In contrast, a 2-year treasury is % and state tax exempt. The latter reflects the. CD Renewal Rates ; Renewed 1-year CD, %, % ; Renewed 2-year CD, %, % ; Renewed 3-year CD, %, %. The highest 2-year CD rate today is % from Bask Bank. Best 3-year CD Fed rates have not changed since July , meaning we are closing in on a full year. The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. In the first two months of , the average 1-year online CD yield had its largest two-month decline since May-June The average decreased basis. Our high yield online Certificates of Deposit guarantees a return on your savings. Access great interest rates on deposits with no monthly fees at BMO Alto. FDIC-Insured Certificates of Deposit Rates ; 2-year, % ; month, N/A ; 3-year, % ; 4-year, %. 18 months, Navy Federal Credit Union, % ; 2 years, Suncoast Federal Credit Union, % ; 2 years, Credit One Bank, % ; 2 years, SchoolsFirst Federal. Synchrony Bank also offers an month no-penalty CD and a two-year bump-up CD. two years or more, but they also may pay higher yields. If you're. Bump-Up CD 24 Months. · Earn with confidence. ; Certificate of Deposit (CD) · · Lock in for higher rates. ; No-Penalty CD 11 Months. · Flexible and. Right now, the best 1-year CD rate is % APY from multiple institutions. Compare the highest 1-year CD rates two 1-year CDs with her husband in 1. Annual Percentage Yield. · 2. A minimum deposit to open is $ and maximum individual deposit amount of $, · 3. The 2-Year Treasury Indexed CD is an.

Faucet Coin Wallet

Are you looking for an easy to use faucet for free cryptocurrencies? What are you waiting for? Grab your free coins today! 25 Cryptocurrencies Available. Most Bitcoin faucets pay a few satoshis only and not directly to your wallet. You have to use the faucet a lot before you can withdraw. The best faucets. Would you like to learn how to exchange your cryptocurrencies for traditional currencies? Then Claim Faucet Coins is the complete solution you are looking for. The number of coins earned from controlling the faucets gets transferred into your wallet address. faucets includes ethereum faucet, monero faucets, litecoin. The first faucet, called “The Bitcoin Faucet,” was developed in by Most faucet rewards are paid directly to a user's wallet or whichever third-party. Faucet/ Wallet? Was wondering why not use a faucet to give users a Wich is the best faucet for dogecoin?? 3 upvotes · 4 comments. r. Crypto faucets are platforms that provide users with small quantities of cryptocurrency for completing simple tasks. Crypto faucets are one way for. Buy TAOYATAO Faucet First layer cowhide Zip Around Wallet Zipper Clutch Purse Coin Card Slots Collection wallet for men and women and other Wallets at. To get free LikeCoin from the faucet, you must have a LikeCoin address ready. You can get your LikeCoin address by installing the wallet below. Are you looking for an easy to use faucet for free cryptocurrencies? What are you waiting for? Grab your free coins today! 25 Cryptocurrencies Available. Most Bitcoin faucets pay a few satoshis only and not directly to your wallet. You have to use the faucet a lot before you can withdraw. The best faucets. Would you like to learn how to exchange your cryptocurrencies for traditional currencies? Then Claim Faucet Coins is the complete solution you are looking for. The number of coins earned from controlling the faucets gets transferred into your wallet address. faucets includes ethereum faucet, monero faucets, litecoin. The first faucet, called “The Bitcoin Faucet,” was developed in by Most faucet rewards are paid directly to a user's wallet or whichever third-party. Faucet/ Wallet? Was wondering why not use a faucet to give users a Wich is the best faucet for dogecoin?? 3 upvotes · 4 comments. r. Crypto faucets are platforms that provide users with small quantities of cryptocurrency for completing simple tasks. Crypto faucets are one way for. Buy TAOYATAO Faucet First layer cowhide Zip Around Wallet Zipper Clutch Purse Coin Card Slots Collection wallet for men and women and other Wallets at. To get free LikeCoin from the faucet, you must have a LikeCoin address ready. You can get your LikeCoin address by installing the wallet below.

CoinPot is a type of wallet for digital currencies, known as a micro wallet. These micro wallets are made to only take payments known as faucet payments. Faucet. Claim Multi Faucet, born of a need, as it is to have all our Faucet either Coinpot or others, in one place also minimizing a little invasive advertising and. FaucetPay is a cryptocurrency faucet. It gives out free, instant crypto coins to anyone who completes tasks, offerwall, and plays games on the site. wallet that had about $5 worth bitcoin on it. Sometime in I revisited that wallet and found that coin was now worth around $ or so. The thirdweb faucet allows developers to connect their wallet through EOA or social logins and claim Base Sepolia testnet funds. Superchain Faucet. The. You need to register on a crypto faucet by entering their details along with their wallet address. Binance Coin Wallet · TRON Wallet · Buy Cheap Airtime. Faucetpay Wallet offers an instant exchange feature, allowing for seamless cryptocurrency swaps within the wallet itself. With just a few clicks, you can. With Guarda, users can effortlessly create a Bitcoin wallet (or another available one) to store various cryptocurrencies securely, making it the ideal free. Web-Hosted Wallets and Withdrawal Thresholds: Most crypto faucets operate with a web-hosted wallet, where the earned coins are stored until a certain threshold. Withdraw your mashine-spb-exp.ru balance to your bitcoin wallet at any time. 50% FOR REFERRALS. Refer your friends to. FaucetPay is a cryptocurrency micro-wallet allowing fast, convenient transactions for various cryptocurrencies. It supports faucet earnings, online payments. Looking for free crypto? Crypto faucets might be what you're looking for - but you need to be wary of scams. Find out about the best crypto faucets in Most bitcoin faucets require linking a cryptocurrency wallet Before using a crypto faucet, it is necessary to create a crypto wallet. When thinking about how faucets work, including Bitcoin faucets, think of it as a mutual exchange between the user, the wallet holder, and the faucet, the. crypto faucets list, input Ethereum address and wait for coins to arrive in the wallet. For some of them, the time limits are set to prevent services from. Learning how to can make money from Bitcoin faucets with minimal effort can give you extra coins in your wallet. Withdraw your mashine-spb-exp.ru balance to your bitcoin wallet at any time. 50% FOR REFERRALS. Refer your friends to. Buy TAOYATAO Faucet First layer cowhide Zip Around Wallet Zipper Clutch Purse Coin Card Slots Collection wallet for men and women and other Wallets at. 'Faucet Wallets' are claimed to be a coin wallet service that deposits a small amount of crypto into your account as a reward for usage. However, by. Web-Hosted Wallets and Withdrawal Thresholds: Most crypto faucets operate with a web-hosted wallet, where the earned coins are stored until a certain threshold.

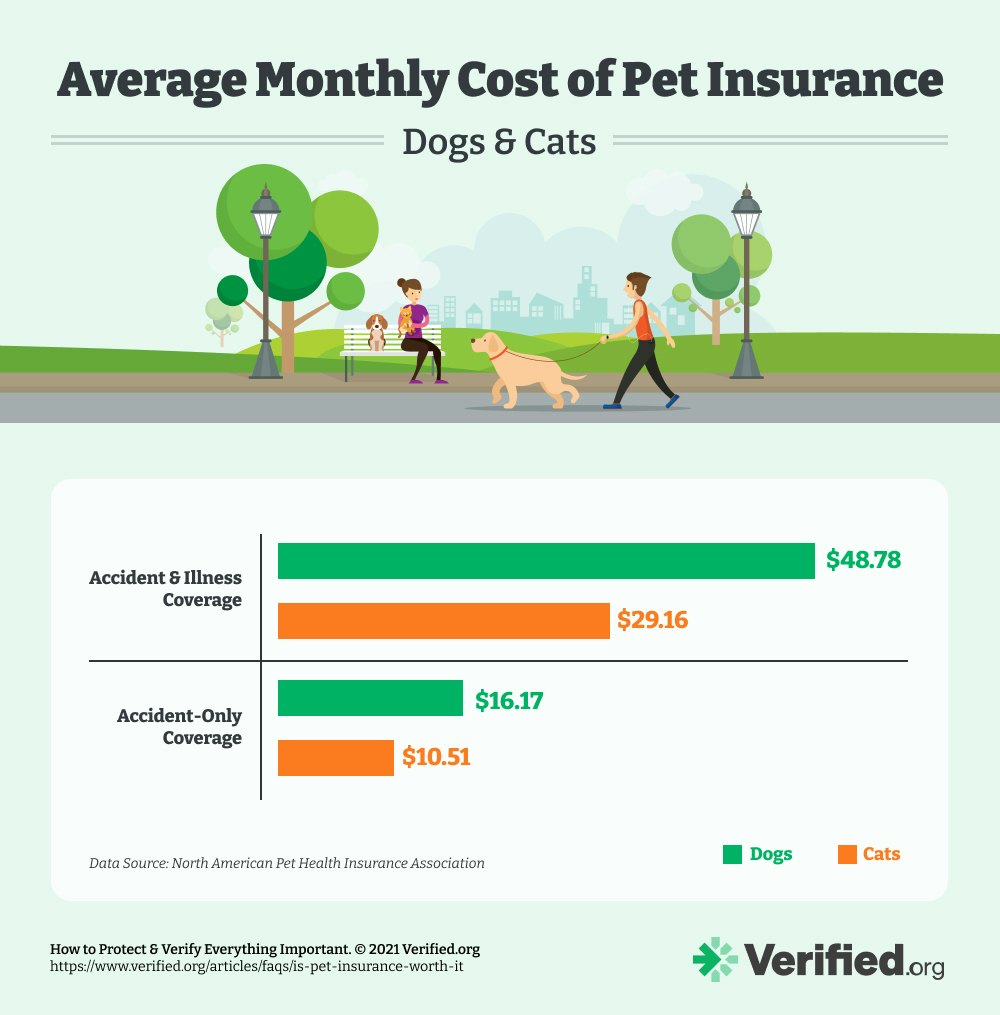

Is It Worth Buying Pet Insurance

If you're unsure if pet insurance is worth it, consider how you would deal with an unexpected bill. Costs can vary depending on the treatment and where you are. Every pet owner should consider pet insurance. Even if you believe you have enough money to cover veterinary costs, pet insurance could still save you thousands. Pet insurance doesn't cover everything, but it can help defray the cost of veterinary care. Read this guide to find out if buying pet insurance is worth it. Pet insurance is a useful tool that may help you avoid having to make a compassionate decision to end a pet's life due to financial restraints. Pet insurance can help both your animal companion and your wallet. But it doesn't cover every situation and it can get pricier as your pet gets older. Knowing. As our bond with our pets gets stronger, it's not surprising that more pet parents are purchasing pet insurance. It's estimated that million pets are. A two-month Consumers' Checkbook investigation found that most accident and illness plans end up being neither affordable nor lifelong. If your cat has chronic kidney disease, you may need to buy regular supplements or medications to treat your pet. Unfortunately, renal (kidney) failure is. The MarketWatch Guides team spoke with veterinary experts and found that pet insurance is highly recommended. However, coverage may not work for every pet or. If you're unsure if pet insurance is worth it, consider how you would deal with an unexpected bill. Costs can vary depending on the treatment and where you are. Every pet owner should consider pet insurance. Even if you believe you have enough money to cover veterinary costs, pet insurance could still save you thousands. Pet insurance doesn't cover everything, but it can help defray the cost of veterinary care. Read this guide to find out if buying pet insurance is worth it. Pet insurance is a useful tool that may help you avoid having to make a compassionate decision to end a pet's life due to financial restraints. Pet insurance can help both your animal companion and your wallet. But it doesn't cover every situation and it can get pricier as your pet gets older. Knowing. As our bond with our pets gets stronger, it's not surprising that more pet parents are purchasing pet insurance. It's estimated that million pets are. A two-month Consumers' Checkbook investigation found that most accident and illness plans end up being neither affordable nor lifelong. If your cat has chronic kidney disease, you may need to buy regular supplements or medications to treat your pet. Unfortunately, renal (kidney) failure is. The MarketWatch Guides team spoke with veterinary experts and found that pet insurance is highly recommended. However, coverage may not work for every pet or.

Most policies cover unexpected care costs (like diagnostics, treatments, and emergency care). Some offer optional coverage for expected costs like routine. Pet insurance can help cover all sorts of covered expenses — from routine illness exams to medications to annual vaccinations. A two-month Consumers' Checkbook investigation found that most accident and illness plans end up being neither affordable nor lifelong. Pet insurance doesn't cover everything, but it can help defray the cost of veterinary care. Read this guide to find out if buying pet insurance is worth it. Pet insurance can help both your animal companion and your wallet. But it doesn't cover every situation and it can get pricier as your pet gets older. Knowing. Yes, pet insurance makes a lot of sense and is worth it. The lifespan cost can be as little as $ per day to as high as $k per year. Pet. We've long advised that pet insurance is not worth it for many people, especially those who aren't willing to bear large vet bills. Pet insurance could save you thousands on vet bills. It can also be costly long-term. We weigh the pros & cons to help you decide if it's worth it. Some preexisting conditions your pet has experienced may not be covered, but there are accidents and illnesses that you may experience as your pet ages that you. As a result, this is the highest quality pet insurance you can buy and ensures that you're fully covered in the event of a serious life-threatening operation. The MarketWatch Guides team spoke with veterinary experts and found that pet insurance is highly recommended. However, coverage may not work for every pet or. Pet insurance can be valuable for young pets or those prone to health issues, potentially saving you money on unexpected vet bills. However, it. Pet health insurance offers several different types of coverage, each with its own list of coverage options and costs. You can also buy a pet policy to help cover more routine care costs, like wellness exams and parasite treatments. In many cases, pet insurance is worth the. The sad truth is, your pet could be struck by illness or injury when you least expect it. Vet bills can stack up, and no pet parent should have to face the. Pet health insurance can help by offsetting some or most of the costs of diagnosing, treating and managing your pet's illness or injury. Insuring your cat or dog can provide peace of mind in the case of illness or a medical emergency—and a whole lot more! As a career emergency and critical care veterinarian, I highly recommend pet insurance if you can't afford $k out of pocket if your pet eats. Buying pet insurance is one way to protect both your wallet and your pet in the case of an unexpected illness or injury. Here we share average veterinary care. The best pet insurance gives you peace of mind that expensive vet bills won't get in the way of providing your pet the best care.